Famous Estate Planning Blunders

Celebrities have enough money to hire the best estate planning lawyers. You would think celebrities, of all people, should have ironclad estate plans that keep their affairs private, leave money and possessions to the people they love and the charities they care about, and take advantage of legal ways to avoid or minimize estate taxes.

Unfortunately, it doesn’t always turn out that way. Celebrities can be negligent about estate planning no matter how much money they have. Other than not having a will, the biggest mistake is relying on a simple will to transfer a sizable estate. By failing to take advantage of trusts, celebrities hurt their loved ones in three ways: 1) a big chunk of the estate is lost to estate taxes; 2) probate proceedings are public and can drag on for years; and 3) their fortune may even end up in the wrong hands.

Prince: $100 million lost to estate taxes

Prince shocked the music world when he suddenly died of an overdose on April 21, 2016. He did not have a will. One year later Time reported that the estate’s first tax payment was due in the amount of $100 million, approximately half the estate’s total value. The remaining estate was split among his six siblings according to his state’s laws of succession. This may or may not have been what Prince would have wanted.

Whitney Houston: Daughter inherited $2 million upon turning 21

Whitney Houston’s will was drawn up in 1993, one month before the birth of her daughter, Bobbi Kristina. It called for her to receive ten percent of Houston’s estate at age 21 and the rest later. But the will was never revised, even as the singer’s fortune grew. When Houston died in 2012, her estate was worth $20 million. Bobbie Kristina got her $2 million at age 21 but lacked the maturity to handle it. She died in 2015 as a result of drowning and drug intoxication. Had Houston placed the money in trust, with her mother or another trusted person serving as trustee, Bobbi Kristina’s inheritance could have been doled out in a more suitable manner.

Philip Seymour Hoffman: $12 million lost to estate taxes, two children not provided for

In 2004, Philip Seymour Hoffman set up a trust for his son but never updated his estate plan after his two daughters were born. He had always said he didn’t want his children to be “trust fund babies.” When he died in 2014 of a drug overdose at the age of 46, his will directed the bulk of his $35 million estate to his longtime girlfriend and mother of his three children, Mimi O’Donnell. Because Hoffman and O’Donnell were not married, the unlimited marital deduction could not be used and the estate was hit with an immediate $12 million estate tax. Properly drafted trusts could have been used to distribute assets to O’Donnell and their three children in a way that would save estate taxes and set conditions as to when, how, and under what circumstances the children would receive their inheritance. At the very least, a trust could have allowed for the money to be used for the children’s education or medical care if needed, without turning them into “trust fund babies.”

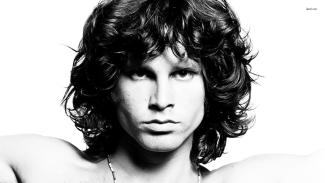

Jim Morrison: Girlfriend’s parents got much of his fortune

The iconic lead singer for the Doors died of a heroin overdose at age 27 in 1971. His will left everything to his girlfriend, Pamela Courson, with the stipulation that if she died within the first three months, the estate would be split equally between Morrison’s brother and sister. Courson lived another three years but never saw much of the estate because it was tied up in probate court. When she died – without a will – the money she inherited from Morrison went to her parents. It was eventually split 50/50 between the two sets of parents. The brother and sister, whom Morrison apparently wanted to share in the estate, got nothing.

James Gandolfini: $30 million lost to estate taxes

Sopranos star James Gandolfini dropped dead of a heart attack after a day touring Rome in 2013. He did have a will and a small life insurance trust for his son. But these were not sufficient to handle his reported $70 million estate. Everything above the $5.25 million exclusion allowed in 2013, and the 20% that went to his wife, was exposed to federal and state estate tax. Published estimates put the tax bill at $30 million.

Only the worst celebrity estate stories hit the news. That’s what happens when a simple will is used to transfer the bulk of the estate and probate proceedings are made public. This is in contrast to the use of trusts, which allow for the transfer of assets quietly and privately. It’s the celebrity estate stories you don’t read about that are the best ones to learn from. If a celebrity dies and there’s nothing in the news about their estate, it means they had a good estate planning attorney and used trusts to transfer their wealth.

Securities offered through Securities Service Network, LLC. Member FINRA/SIPC. Fee based services are offered through SSN Advisory, Inc., a registered investment advisor.